What’s the Line of Credit (LOC)?

May 15, 2024 By Susan Kelly

Knowing about the idea of a Line of Credit (LOC) is very important in personal and business finance. A LOC represents a flexible borrowing deal between you or your company with some kind of financial organization. This provides an agreed-upon highest possible loan balance which can be used whenever needed. This article is intended to explain the different aspects of LOCs, including their meaning, kinds, and instances.

Definition of Line of Credit (LOC)

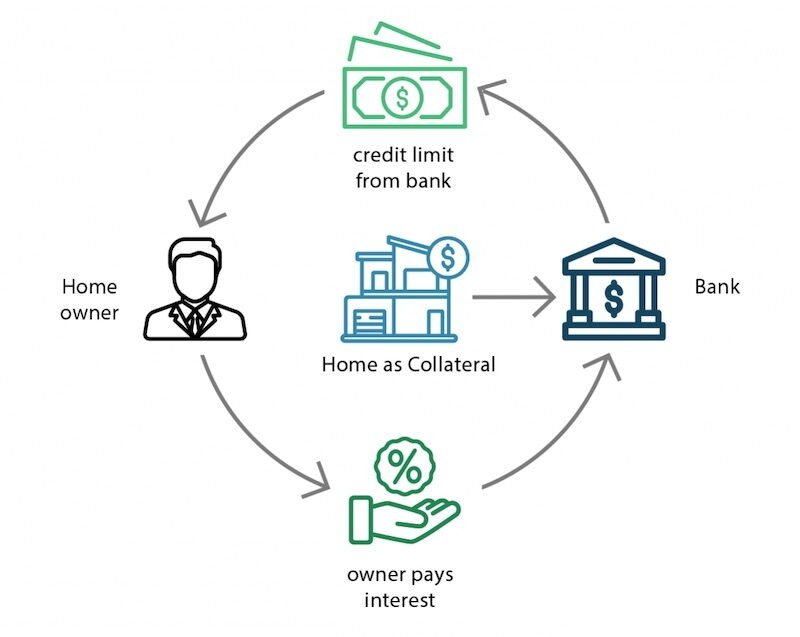

A Line of Credit (LOC) works like a lifeline in money handling, giving people who borrow it a type of borrowing that is not the same as regular loan methods. This kind of credit facility, which can be used again and again, gives those who borrow it the power to draw on an agreed credit limit whenever they require funds. A LOC is different from typical loans where all money gets paid out at once because, with this type of credit line, you only pay interest for what has been used so far. For people or companies that deal with changing money movements or unexpected costs, this characteristic is very useful.

More explanations are, that knowing the details of interest rates in a line of credit is essential. The interest rates for LOCs can change frequently due to market situations and how much worthiness the borrower has. Sometimes, your LOC could have an initial time where less interest is charged as an encouragement for you to borrow more money from it. But, borrowers need to carefully check the details, like if interest rates might change, before they decide on taking a loan.

- Consideration: Before opting for a LOC, carefully assess the terms and conditions, including interest rates and repayment terms, to ensure compatibility with your financial objectives.

- Caution: Be mindful of potential fluctuations in interest rates over the lifespan of the LOC, as this can impact borrowing costs significantly.

Types of Line of Credit (LOC)

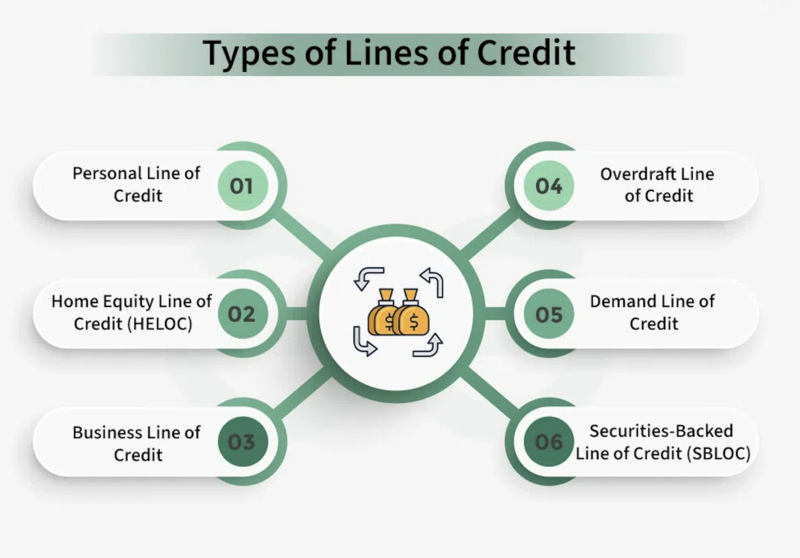

Line of Credit (LOC) facilities have different types, each created to handle specific financial requirements and risk levels. Secured LOCs ask borrowers for something valuable as a guarantee, like real estate or investments; this gives lenders some protection in case of non-payment. On the other hand, unsecured LOCs don't need any collateral but usually have more expensive interest rates because they are seen as riskier for lenders. Additionally, companies can use specific LOCs made for their type of work and operational needs. For example, they may have seasonal lines to handle changes in income during certain times.

Furthermore, it is crucial to comprehend the eligibility requirements for distinct kinds of LOCs. Usually, secured LOCs need a strong credit history and enough collateral to secure the loan. On the other hand, unsecured LOCs might ask for a better credit score and proof that you can pay back without any collateral. In addition, businesses looking for particular LOCs, must give detailed financial papers and show the practicality of their operations.

- Fact: Secured LOCs often offer lower interest rates compared to unsecured counterparts due to the reduced risk for lenders.

- Noteworthy: Businesses should meticulously prepare financial statements and projections when applying for specialized LOCs to enhance their credibility and chances of approval.

Personal Line of Credit (LOC)

A Personal Line of Credit, also known as a LOC, is a type of financial tool that offers flexibility in managing money for individuals. It can be used for various purposes like making changes to your house, bringing together debts, or handling sudden costs. A personal LOC gives people a cushion to handle the unknowns in life's financial situations. You have an agreed-upon maximum amount you can borrow on this line of credit and only pay interest on what you use or take out from it. As time goes by, you return the borrowed money along with any added interest into your available credit balance again - ready for whenever the next situation arises where funds might be required once more from this particular account type: personal line-of-credit (LOC). This borrowing flexibility gives power to people, allowing them to deal with sudden financial requirements without using expensive credit cards or depleting their savings.

Also, when people use a Personal LOC, they must demonstrate good borrowing behavior. Although the continuing cycle of LOCs brings ease, it's necessary to borrow only what's required and keep consistent repayment plans so as not to let interest charges accumulate too much. Moreover, regularly checking and evaluating if the terms of your LOC match your changing financial objectives can help you utilize it in the best way possible while minimizing the risk factors involved.

- Consideration: Regularly review the terms and conditions of your LOC to ensure they align with your evolving financial needs and objectives.

- Noteworthy: Responsible borrowing and timely repayment are essential when utilizing a Personal LOC to maintain healthy credit habits and avoid unnecessary interest charges.

Business Line of Credit (LOC)

In the world of business, companies use Line of Credit (LOC) facilities to handle their cash flow and take advantage of chances for growth in ever-changing market situations. A Business LOC works like a main tool for managing working capital requirements, helping with purchases of inventory, and dealing with changes in income. It offers fast access to money so that businesses can keep their liquidity, pay for running expenses, and make use of important plans without causing problems in daily running matters.

Moreover, when businesses think about an LOC, they ought to carefully review their financial results and forecasts for cash flow. Lenders consider things like how steady the revenue is, if the business makes a profit and what's happening in its industry to assess creditworthiness for approving a line of credit (LOC). Additionally, businesses need to have backup plans ready in case of unexpected difficulties. This helps make sure that there are no interruptions when getting funds through a LOC for safeguarding against potential disruptions.

- Fact: Business LOCs offer flexibility in borrowing and repayment, allowing companies to adapt to changing market conditions and capitalize on growth opportunities.

- Noteworthy: Maintaining open communication with lenders and proactively addressing any concerns can foster a collaborative relationship and potentially lead to more favorable terms for a Business LOC.

Examples of Line of Credit (LOC) Usage

The usefulness of Line of Credit (LOC) facilities for businesses and individuals is shown in real-life examples. Imagine a small business that works in an industry affected by seasons, like tourism or farming. By getting a seasonal LOC, the business can have more money available during busy times to increase inventory, promote marketing, or employ temporary staff. When it is not a high-demand time, the business can reduce borrowing money and concentrate on saving cash flow for continuing operations until demand increases again.

Additionally, a person could utilize a Personal LOC for managing expenses that are not planned or to achieve financial objectives over the long term. For example, someone who owns a home might use their LOC to fund house improvements slowly. This way they wouldn't need a one-time loan and can spread out the cost of renovation work across time. In the same manner, people dealing with medical emergencies or sudden repairs may access their Personal LOCs to pay for these costs without using up all of their savings and avoiding high-interest credit possibilities.

- Consideration: Evaluate the cost-effectiveness of utilizing an LOC compared to alternative financing options to ensure optimal financial outcomes.

- Noteworthy: Maintaining discipline in borrowing and repayment is crucial when utilizing a LOC to avoid overextending finances and accruing unnecessary interest charges.

Conclusion

In conclusion, a Line of Credit (LOC) facility is a flexible way to get finance for people and businesses. It gives access to money when needed, making it useful in various circumstances. Knowing about the types of LOCs like those that are secured or unsecured helps borrowers understand what they can do with their money depending on how much risk they want to take on. By seeing examples of using LOC in actual life situations, one can understand its importance for making cash flow better, controlling expenses, and taking chances for growth. To face financial difficulties or follow plans, a LOC might be an important instrument for reaching economic strength and success.

Jan 13, 2024

Investment

What is CrowdStreet and How to Use it?

Let’s understand the basics of real estate investing with CrowdStreet. Learn how this platform helps investors to make contributions to the commercial real estate market.

Dec 14, 2023

Investment

Decoding the Investment Duel: Fidelity vs. Schwab

Embark on a journey to decode the battle between Fidelity and Schwab. Our simplified guide delves into the nuances, helping you strategically decide where to grow your wealth.

Nov 10, 2023

Mortgages

U.S. Bank Personal Loans

If you are a client of U.S. Bank and have a FICO score of 660 or better, then a personal loan from U.S. Bank may be something you want to consider. This creditor has advantageous conditions, and after applying, you can have the money you need within a few hours at the most.

Oct 25, 2023

Investment

The Problem with the 60/40 Portfolio

The 60/40 portfolio, a mainstay of savvy investors for decades, doesn't seem to be adapting to the modern market environment. Many financial advisors now suggest that rather than putting all of one's eggs in the stock and bond markets, investors diversify their holdings across a variety of other asset types. Hedge funds, commodities, private equity, and inflation-protected assets are relatively new additions to the conventional well-balanced portfolio.

May 15, 2024

Mortgages

What’s the Line of Credit (LOC)?

Learn about Line of Credit (LOC) including its definition, types, and real-life examples. Understand how LOCs work and their significance in finance.

Oct 10, 2023

Taxes

The Year 2022's Finest Tax Preparation Guides

Filing your taxes may be a hassle, as the name suggests. There is several paperwork to fill out, and mistakes might have serious consequences. You should review your tax knowledge before tax season since the tax code is continually changing.

Oct 25, 2023

Mortgages

What are Mortgage-Backed Securities (MBS): Discuss Briefly

In the bond market, mortgage-backed securities (MBS) are a standard investment option. Mortgage-backed securities (MBS) are bundles of home loans and other real estate debt purchased from the issuing banks. Similar to bond coupon payments, mortgage-backed security investors receive regular income.

May 17, 2024

Investment

Understanding the Basics of the Stock Market

Learn the fundamentals of the stock market, investment, and trading in this comprehensive guide.

Nov 16, 2023

Investment

A Guide About What Is A Like-Kind Exchange?

It is possible to avoid paying capital gains taxes by trading one asset for another in a like-kind exchange. For tax purposes, like-kind exchanges are closely scrutinized by the IRS and require correct bookkeeping to avoid any penalties. Like-kind exchanges can be used to defer other sorts of profits, like as depreciation, by savvy sellers. In a like-kind swap, taxes are postponed rather than avoided. The seller is able to postpone the recapture of any depreciation on the transaction if it is a like-kind exchange.

Dec 23, 2023

Investment

What are The best ways to Buy Municipal Bonds Directly

Direct internet trading, often known as self-managed accounts, is a way for investors to buy and sell municipal bonds without the mediation of a private client broker.

Oct 11, 2023

Taxes

What Is a Personal Exemption: An Eccentric Guide

Each individual the taxpayer provided was exempt from taxation up to the amount of money set aside for subsistence. To claim personal immunity, the taxpayer must demonstrate that their spouse or dependents meet specific criteria.

Nov 02, 2023

Investment

Investments: What Is It? Avoiding Investing Mistakes the Rich Don't Make

As a group, ultra-high-net-worth persons with at least $30 million (UHNWIs). 1 Stock in private and public businesses, property, and other assets like art, airplanes, and luxury vehicles make these people very wealthy. If you look at these UHNWIs, you might think there's some secret investment strategy you can use to get to their level of wealth. This isn't always the case. On the other hand, they know how to put their resources to work for them by taking calculated risks.