Understanding the Basics of the Stock Market

May 17, 2024 By Susan Kelly

The stock market is a place where people, who are called investors, can buy and sell parts (we call them "shares") of companies that have been listed publicly. This part of the global financial system plays an important role in helping businesses collect money and letting investors possibly increase their riches. In this article we will talk about how the stock market works inside, giving details on its functions, what it means to invest, and how trading happens.

Stock Market Fundamentals

To understand the stock market, it is very important to know about the main people involved in it. In general, two types of individuals participate: investors and traders. The investor category usually seeks growth over a long period, emphasizing how their investments can appreciate as time goes on. Yet, traders do buying and selling more often. They may want to make money from quick changes in stock costs for short periods.

Apart from the investors and traders, other important participants in the stock market ecosystem are brokerage firms, market makers, and regulatory agencies. Brokerage firms are intermediaries that help investors to buy or sell securities. Market makers play a crucial role in maintaining liquidity by constantly providing buy and sell prices for particular stocks. Market control is done by regulatory organizations like the Securities and Exchange Commission (SEC). They make sure rules for securities are followed, and they watch over market actions while also safeguarding investor interests.

- Brokerage Firms: These firms provide a range of services, including executing trades, offering investment advice, and managing client portfolios.

- Market Makers: These entities play a crucial role in maintaining market liquidity by facilitating trading activity and narrowing bid-ask spreads.

Investment Strategies

Investment plans in the stock market are very diverse, based on many elements like how much risk someone can handle, their financial objectives, and also the period they desire to keep their investment. Some investors choose a careful method, choosing to distribute their holdings among steady stocks that give dividends. On the other hand, some might take on an aggressive tactic by going after stocks with the potential for high growth or participating in frequent trade activities that can benefit from changes in market prices.

Alongside the common investment methods, other options like value investing, growth investing, and momentum trading are also widespread in the stock market. For example, value investors want to find stocks that are not evaluated correctly; they trade at a price lower than their real worth and have chances for future increases in value. On the other hand, growth investors concentrate on firms that show promise of strong earnings growth along with growing opportunities within markets. Traders using momentum tactics benefit from quick price changes, they buy shares that are increasing in value and sell the ones that are decreasing.

- Value Investing: This strategy involves identifying undervalued stocks trading at a discount to their intrinsic value based on fundamental analysis.

- Growth Investing: Investors employing this strategy target companies with strong earnings growth potential and promising business prospects for long-term capital appreciation.

Market Analysis and Research

To achieve success in the stock market, it is necessary to carefully research and analyze before investing. Investors typically assess a company's financial condition, the team managing it, its competitive standing, and trends within its industry before deciding on whether or not they should invest. Technical analysis includes examining price graphs and trade volume as well; this method is frequently used by traders for spotting possible times to buy or sell.

Additionally, basic analysis is important in judging the real value of a company's stock. It involves studying financial statements, earnings reports, and business basics. Usually, ratios like price-to-earnings (P/E), price-to-book (P/B), and debt-to-equity (D/E) are utilized for evaluating a stock's worth and financial condition.

- Fundamental Analysis: This method involves evaluating a company's financial performance, management team, competitive advantages, and industry outlook to determine its intrinsic value and growth potential.

- Technical Analysis: Traders use price charts, indicators, and patterns to forecast future price movements and identify entry and exit points for trades.

Market Mechanics - Buying and Selling

Buying and selling stocks in the market involves a series of steps facilitated by brokerage firms. Investors place orders to buy or sell shares through brokerage platforms, specifying the desired quantity and price. Market orders are executed at the prevailing market price, while limit orders allow investors to set a specific price at which they are willing to buy or sell. Once an order is fulfilled, ownership of the shares is transferred, and the transaction is settled.

Additionally, the carrying out of orders can happen in diverse trading places like stock exchanges and electronic communication networks (ECNs). The stock exchange, such as the New York Stock Exchange (NYSE) and Nasdaq Stock Market, is a centralized place where buyers and sellers can trade securities in an organized way. In contrast to this, ECN gives electronic trading platforms that match buying and selling orders from different market players. It increases liquidity as well as effectiveness.

- Electronic Communication Networks (ECNs): These platforms enable direct access to the stock market, allowing traders to interact anonymously and execute trades without the need for traditional brokerage intermediaries.

- Clearing and Settlement: After a trade is executed, the process of clearing and settlement ensures that the transaction is finalized, and ownership of the securities is transferred between the buyer and seller.

Market Performance and Indices

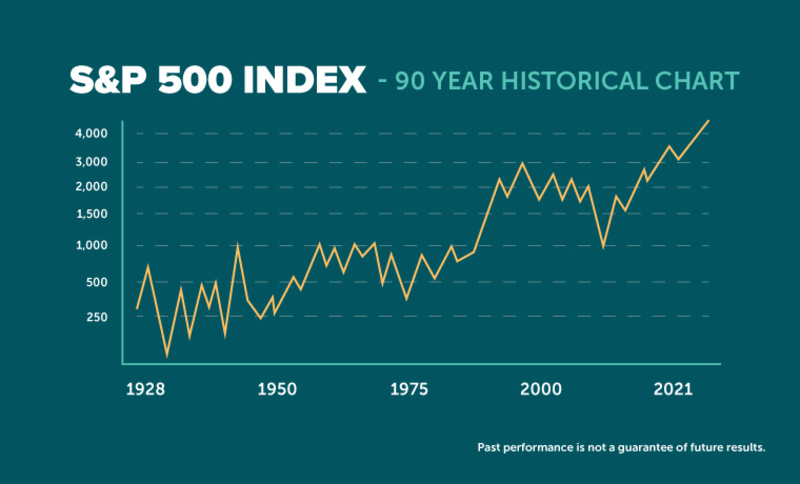

The way to know about how the market is doing usually involves looking at stock market indices, which can be seen as measurement tools for the overall health of a certain market. Indices like S&P 500, Dow Jones Industrial Average, and Nasdaq Composite offer information on how select stocks from different sectors are performing together. People who invest use these reference points to understand trends in the market, measure their portfolio's performance, and decide where they should put their money.

Additionally, market indices are grouped into types depending on various factors like market capitalization, sector makeup, or country location. To illustrate this point further: global indices such as the MSCI World Index monitor stock performance across many countries worldwide and offer a wide-ranging view of worldwide equity markets; on the other hand, sectoral ones like the S&P 500 Information Technology Index concentrate solely on stocks within a specific industry field enabling investors to watch over trendlines and chances particular to their field.

- Index Investing: Investors can gain exposure to broad market trends and diversify their portfolios by investing in index funds or exchange-traded funds (ETFs) that track popular market indices.

- Volatility Index (VIX): Also known as the fear index, the VIX measures market volatility and investor sentiment, reflecting expectations for future market volatility based on options trading activity.

Market Regulation and Oversight

Stock market regulation is very important, as it helps to keep the stock market fair and stable. Bodies that regulate, like in the United States the Securities and Exchange Commission (SEC), enforce rules for safeguarding investors' interests, making sure there are honest and open markets as well as preventing frauds. Stock exchanges also have their own rules for listing requirements and trading methods to maintain an orderly operation of the market.

Also, rules on insider trading, programs for keeping watch over the market, and requirements for revealing information all add to making the market more visible and giving investors trust. These rules are designed to stop manipulation in the market, protect investor benefits, and make sure that everyone participating in this space has an equal chance.

- Insider Trading Regulations: These regulations prohibit individuals from trading securities based on non-public, material information, ensuring fair and equitable access to market information for all investors.

- Market Surveillance Programs: Stock exchanges employ sophisticated surveillance systems to detect unusual trading activity, monitor market manipulation, and maintain market integrity.

Conclusion

To sum up, the stock market acts like a vibrant environment where people who invest and trade come together to purchase or vend securities. It is very important for everyone who wants to involve themselves in the intricate world of stock investing, to comprehend its basics, investment plans, market study methods, and control structure. People can take advantage of the possibilities offered by the stock market if they keep themselves updated and apply good investment principles while managing risks carefully.

Nov 18, 2023

Banking

Reasons Why Banks Don't Need Your Money to Make Loans

Banks serve as a bridge between borrowers and savers in the financial system. On the other hand, banks use a fractional reserve banking system that allows them to lend more money than they have in their accounts.

Oct 11, 2023

Taxes

What Is a Personal Exemption: An Eccentric Guide

Each individual the taxpayer provided was exempt from taxation up to the amount of money set aside for subsistence. To claim personal immunity, the taxpayer must demonstrate that their spouse or dependents meet specific criteria.

Nov 02, 2023

Investment

Investments: What Is It? Avoiding Investing Mistakes the Rich Don't Make

As a group, ultra-high-net-worth persons with at least $30 million (UHNWIs). 1 Stock in private and public businesses, property, and other assets like art, airplanes, and luxury vehicles make these people very wealthy. If you look at these UHNWIs, you might think there's some secret investment strategy you can use to get to their level of wealth. This isn't always the case. On the other hand, they know how to put their resources to work for them by taking calculated risks.

Feb 25, 2024

Banking

The Effect Of A Blank Balance On Your Credit Score

The day may come when you discover you've neglected a credit card. It wasn't done on purpose; perhaps you have an unused card from when you were initially getting started. Alternatively, it might be a gift card to a store you no longer frequent, or a petrol gift card from before you gave up your automobile and relocated to the city.

Nov 02, 2023

Banking

How to Rewind ACH Transactions

If you have already started making ACH payments but now want to stop, you have had the constitutional entitlement to do so. want to stop. To do this, contact the biller by phone or email and ask them to cease making automatic payments. Send a note to your local bank to let them know as well

Feb 08, 2024

Investment

High-Yield Muni Bond ETFs

Exchange-traded funds (ETFs) that invest in high-yield municipal bonds make their investments in the debt, or other local government bodies

Nov 07, 2023

Banking

Credit Reports: An Overview and Guide

A good consumer credit score may have far-reaching consequences on your financial condition, so it's important to be conversant with the information contained in your report. Lenders use your credit score when considering whether or not to provide you with a loan, credit card, or credit line. To determine whether to provide you credit and at what interest rate, creditors often look at your credit score.

Jan 16, 2024

Banking

Credit Card Tips For Beginners

This article will give an expert view of the best tips to help you use your credit card correctly.

Nov 29, 2023

Banking

Southwest Rapid Rewards Plus Credit Card Review: A Complete Guide

The first credit card offered by Southwest is the Southwest Rapid Rewards Plus Credit Card. You may receive this card by applying online. This card provides favourable travel coverage and an anniversary point bonus that may pay for more than half of the annual charge. Despite the low yearly fee of just $69, this card costs more than it is worth.

Dec 01, 2023

Banking

Walgreens Credit Card

You will accumulate incentives through Walgreens Cash, which you can use to pay for purchases made at either Walgreens or Duane Reade.

Oct 10, 2023

Taxes

The Year 2022's Finest Tax Preparation Guides

Filing your taxes may be a hassle, as the name suggests. There is several paperwork to fill out, and mistakes might have serious consequences. You should review your tax knowledge before tax season since the tax code is continually changing.

Nov 16, 2023

Investment

A Guide About What Is A Like-Kind Exchange?

It is possible to avoid paying capital gains taxes by trading one asset for another in a like-kind exchange. For tax purposes, like-kind exchanges are closely scrutinized by the IRS and require correct bookkeeping to avoid any penalties. Like-kind exchanges can be used to defer other sorts of profits, like as depreciation, by savvy sellers. In a like-kind swap, taxes are postponed rather than avoided. The seller is able to postpone the recapture of any depreciation on the transaction if it is a like-kind exchange.